The Corona Virus. For weeks there was calm. Then suddenly there was panic. Admittedly, it was surprising. Markets have been moving upwards without a hitch for a while and initially they shrugged the Coronavirus off. Australian investors, getting little joy from cash, may have been pushing into the market. The US has been offering solid economic growth to underpin its market.

So normally the panic would have started earlier. With the market panic started, the question becomes: what now? Endless words are dedicated to how to behave when things go south. We regularly remind investors about the worst. Hopefully it means the worst is no surprise, but feelings happen. It’s ok to have feelings, just remember the market doesn’t care about feelings.

We can feel quite brave on the way up, but when the plunge happens it can be another story.

Some things to consider.

The Media

The media will continue in their attempt to pump up the issue. “How many billions wiped” and “What it means for your super” will be common leads. Various media organisations started “live blogging” the ASX trading day after a few days of falls. If you’re curious what that entails, along with an insight into the media’s motives. They sit there as the market falls 2% at open and tell us the market has fallen 2% at open. For the rest of the day they hunt every piece of ghoulish news they can find. It’s added to a continuously refreshing page on their website.

Anyone bothering to scroll through such a cornucopia of despair would likely be in the fetal position by the end of it. Incendiary and pathetic stuff. Meant to bring out the worst.

Garth Turner, a Canadian financial adviser, who was also once a journalist, wrote the following about the 1987 market crash. At the time he was business editor at the Toronto Sun.

By the time I sat down to write my daily column the Dow had collapsed 22.6%. In one day. The worst crash on record. More than 1929. Terrifying. As I wrote I glanced up at a crowd of co-workers standing around that dinging clunker in mute shock. Then I sent my assistant to the newsroom library to dig up pictures of breadlines from Depression-era Toronto, which I irresponsibly published the next morning.

So what happened?

Despite the historic disaster in the autumn, 1987 finished positive for the markets. Over the next two years it advanced 12% and 26%. No 1930’s rerun. Everyone who sold on October 20th seriously regretted it. And I regret I lacked the experience and knowledge to do what my public-facing job demanded – provide a balanced and responsible commentary.

Such reflection is rare. There won’t be any of it from the media for as long as the Coronavirus lasts. Keep that in mind.

The Markets

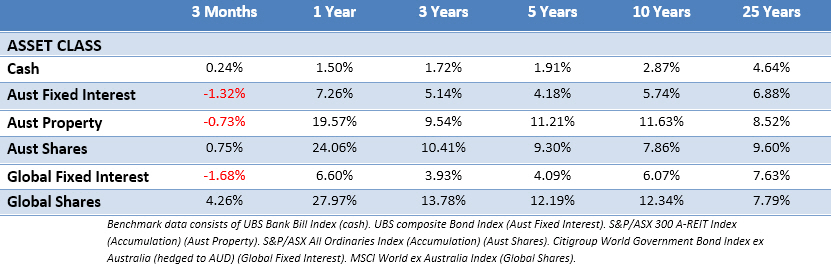

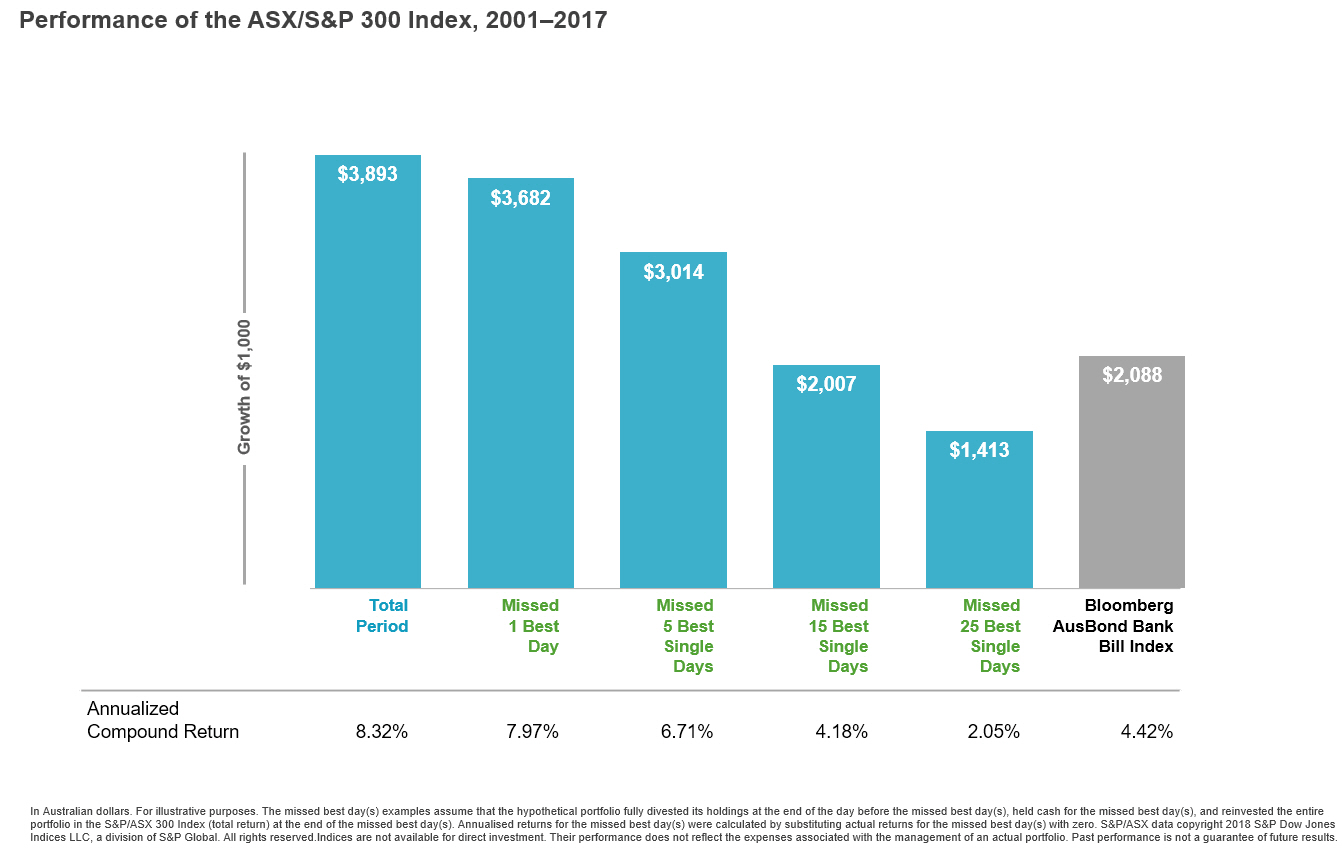

Don’t lose sight that corrections aren’t rare. Australian and world sharemarkets have been on a tear for a while. A genuine correction has been absent. That is rare. We’ve been in a good paddock. Last August we had a 5% pullback before a quick recovery. It’s been steadily upwards until this week.

Some perspective with this chart. The grey lines highlight the ASX All Ords annual returns (absent dividends) for the past 35 years. The red dots represent the largest annual falls the market had during those 35 years.

The dots don’t lie. Most years there will be a double-digit fall. The average fall in this instance is 12%. Usually there is another minor sell off throughout the year. Two sell offs a year. It’s the price of admission.

It’s important to take note of the ‘flattish’ years. Where there is a 0% or slightly negative or positive return. An investor may have to ride a 17% correction to get a 0% return from the sharemarket for that year. The reality of risk. Not pretty, but the best system we have. For some it’s not palatable. It’s why they don’t invest. Alternatively, they seek refuge in the arms of those promising safety and returns without risk. That rarely ends well.

You and Us

As your adviser, we will be humble enough to admit we don’t know anything about this virus, nor where it might take us. Anyone who offers any certainty should be dismissed. We can look at the past

as a guide for market impact, however it’s no road map. The Coronavirus is spreading faster than previous epidemics. Thankfully it appears less deadly.

Markets are unpredictable so we plan around lives and goals. We’re not trying to avoid the red or only capture the green. Your portfolio’s focus is the whole and what that amounts to over a longer period. Portfolios and budgets are built around the good, bad and ugly. Keep in mind you won’t have 100% of your portfolio in sharemarket funds.

For retired clients: We use effective cash management strategies. Taking advantage of harvesting and rebalancing opportunities. This is intended to quarantine cash for spending needs. It also aims to keep investors from selling down when markets are falling.

If you challenged us last year about selling from a fund that was performing well. This is the exact reason why it happened. Gains get quarantined when the opportunity arises. Your cashflow needs are met without going back to your portfolio in uncertain times.

For accumulators or opportunists: We don’t time markets, but a sharp fall or correction is better thought of as a discount. It’s just not advertised that way. If you believe we will overcome and get through this, as with every other challenge humanity has faced, November’s prices are now available in equities again.

Some guesses on things that may happen:

The virus will likely get worse. Then it will likely better. Central banks will intervene. Governments will likely spray some stimulus. Economies will spike as demand returns. Markets will recover as the American election cycle hurtles towards a conclusion. Australia’s economy will remain sluggish. US Corporate profits will continue. People who ignore things will sail through. Those who panic and sell will regret it later.

There are no fixed dates on any of these things. All remain guesses, but we’ve seen enough to be certain of the last two.

Most importantly – take care of your health.

This represents general information only. Before making any financial or investment decisions, we recommend you consult a financial planner to take into account your personal investment objectives, financial situation and individual needs.