There’s a never-ending cast of characters out in the world who have big opinions on the direction of financial markets. They might run their own newsletters or even their own funds. A number of them are permanently bearish. It’s a way of life and they can’t see things any other way (or their wallets don’t allow them to). They do fill a niche, milking unfortunate souls of their cash or delivering them returns that can only be defended if those souls exist in a permanently dark headspace where the end is always around the corner.

It would be fine if these people toiled away in obscurity, but our media has a feverish addiction to finding the most titillating forecasts. It then shines them into the sky, like the signal used by the Gotham City Police Department to attract Batman’s attention when they need his help. The only difference is the media are trying to attract the average investor’s attention, without any virtuous intent. The most eye-catching market stories always revolve around massive market falls.

Because these people may have once correctly forecast an outcome, that’s seen as credibility enough to publish their forecasts evermore. Over the past few months some of these characters have again been platformed by the media, but things have become much more extreme. Of course there’s noted kook, Rich Dad Poor Dad author, Robert Kiyosaki who is now forecasting the biggest crash of all time. Kiyosaki used to forecast crashes that never happened on a yearly basis, but now he has a twitter or X account, he’s now doing it every few months.

Not to be outdone, another noted doomer, Harry Dent has also predicted the “crash of a lifetime” amounting to an 86% fall in the S&P 500. Dent has a very patchy record on forecasting. In 1999 he predicted a boom, but ran into the dotcom crash. In 2009 he predicted a depression, which never happened. Dent does have a very good record attracting media attention and selling “end of days” books. This time Dent has threatened to quit forecasting if he’s wrong. Fingers crossed.

The last to step up to the plate is John Hussman. Hussman’s noted for picking the declines of 2000 and 2008. He’s said he’s not making a forecast, but he wouldn’t be surprised to see a near term market decline over 10% and a longer-term decline of up to 65%. Unlike Kiyosaki and Dent, Hussman has some skin in the investment game as an investment manager. That could be viewed as admirable, or disreputable, given he’s managing other people’s money.

Hussman is a former economics professor at the University of Michigan, with a Ph.D. from Stanford. Smart guy. And it’s worthwhile noting, at one point, Hussman had a track record of some distinction. During the 90’s he ran a newsletter and if his forecasts about disaster weren’t exactly on the money, his stock picking was impressive. His calculated returns regularly trounced the market and was often quoted in investment columns. Buoyed by his newsletter stock picking success, in 2000 he became a fully fledged investment manager, starting Hussman Strategic Growth Fund.

Hussman started off impressively. His Strategic Growth Fund’s only negative year for the 2000’s was 2008. And that was a very respectable -9.02% when the S&P 500 was down -38.62%. He significantly outperformed over that decade. This set the stage for Hussman to be listened to, often quoted, and presumably able to attract plenty of money from investors looking to invest with such a genius.

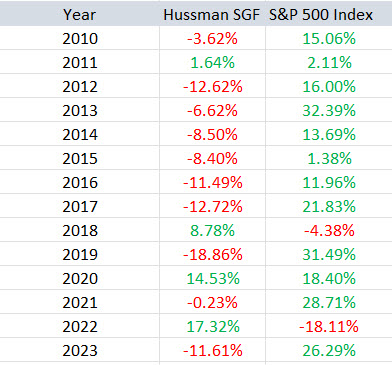

Unfortunately, as is so often the case with people who’ve correctly predicted something, or shot the lights out with outstanding performance, it’s a one off or they can’t maintain it. Across the 2010’s Hussman’s Strategic Growth Fund had two positive calendar years, and he’s had four positive years in fourteen.

The following table lays out the stark reality of Hussman’s performance since 2010.

But the media keep putting Hussman’s name up in lights. Just this week the Australian Financial Review’s Chanticleer column was reasoning that Hussman’s views are worthy of attention. Their caveat? Hussman’s recent five-year performance wasn’t great, but he was the guy who predicted 2000 & 2008! It wasn’t just five years of underperformance, they failed to acknowledge Hussman’s performance has been shameful for 14 years.

To be fair to Hussman, it appears he doesn’t go seeking out attention for his views. He merely publishes what he thinks on his website and the media pillages it and disseminates it to a wider audience. They’re always sure to mention “this is the guy who predicted 2000 and 2008” to make it seem more compelling. What they always leave out is Hussman is also the guy who called for massive crashes in 2013, 2014, 2015, 2016, 2017, 2018, 2019… you get the idea.

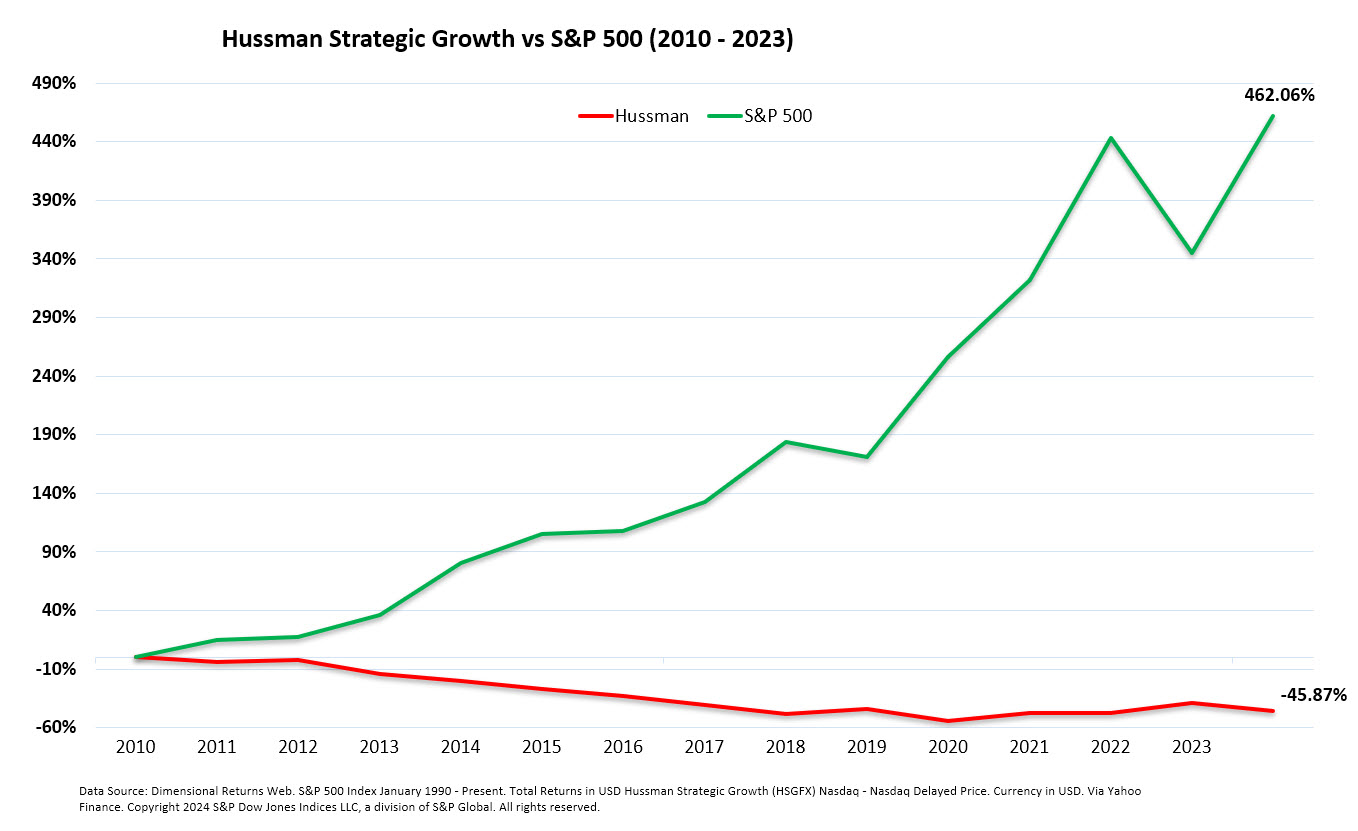

On the more realistic side, Hussman said he wouldn’t be surprised to see a 10% decline in the near term. We don’t disagree. It’s not a revelation because it’s almost an annual occurrence. As the following chart shows.

Hussman’s ongoing analysis of what he thinks will happen and why things didn’t turn out like he expected, reads well. He’s got very intelligent sounding arguments, with rational analysis, and it’s all very seductive. Then he starts attaching them to monster crash and economic depression calls, the likes of which have only been seen once since 1926. That was back when policy makers and central banks were less likely to intervene, and stockmarkets themselves didn’t have circuit breakers. But tales of these outcomes appeal to some.

This is the saddest thing about these types of forecasters. They’ll all have their believers and defenders who’ll be willing to accept “it’s just the timing that’s off”. Someone who has invested with John Hussman over the past decade or more will likely never catch up what’s been lost, even if a massive crash did occur. As the cumulative growth of the S&P 500 and the cumulative loss of the Hussman Strategic Growth Fund shows.

Imagine you were in the red line for the past 14 years. You’d be wrecked.

With billions of people coming together on a daily basis to trade on financial markets, maybe the collective wisdom of the market knows better than any single one of us what it’s doing.

This represents general information only. Before making any financial or investment decisions, we recommend you consult a financial planner to take into account your personal investment objectives, financial situation and individual needs.