Economic Overview

Labour and supply shortages, shipping bottlenecks, COVID delta variant, inflation, vaccine hesitancy. There were plenty of worries in Q3, but markets remained mostly positive across the quarter as economies continued to open and society resumed some normality. This led to an increase in demand in many areas and a struggle to supply that demand. Something governments, businesses and central banks will be dealing with in the year ahead.

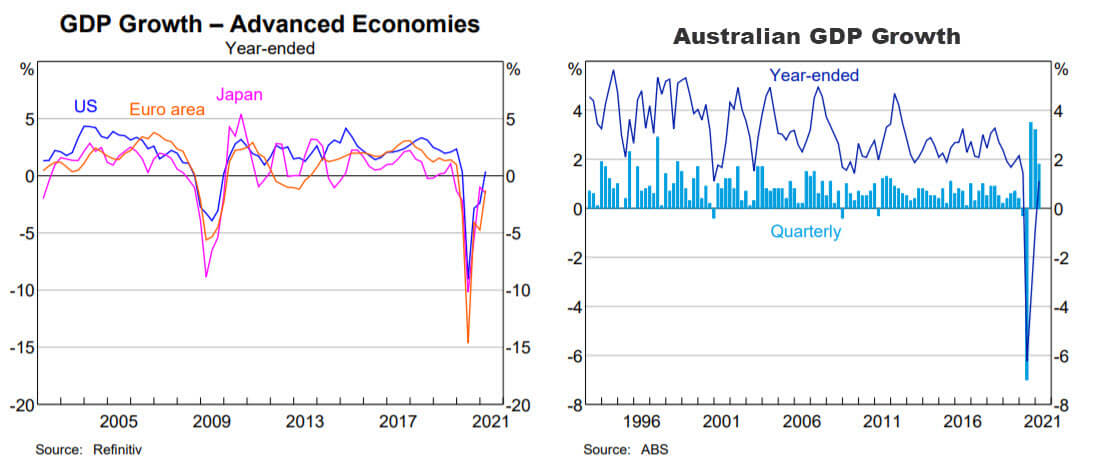

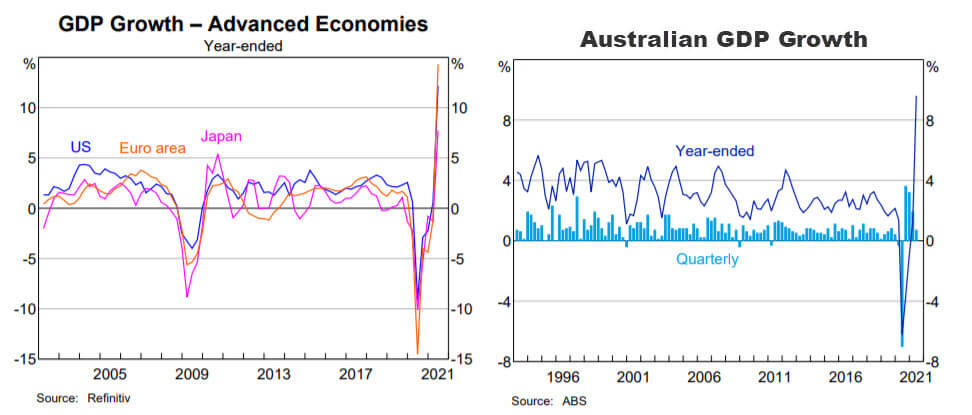

In the US, the Fed Reserve stated tapering of quantitative easing will be announced at the November meeting and will finish by mid-2022. Interest rate expectations also moved higher. The 2023 interest rate expectation moved from two increases to three, with another three increases expected in 2024. While 2021 real GDP growth was revised down to 5.9% from 7% growth previously estimated, GDP projections for 2022 and 2023 were increased. Notably, inflation has risen with the Fed now seeing inflation running at 4.2% across 2021, above its previous estimate of 3.4%. Inflation did slow in July and August at 5.35% and 5.25% on the year, but edged up in September to 5.39% annually. These figures are around 13-year highs.

COVID continues to hamper the supply chain, the third largest container port in China was shut for several weeks in August due to one positive COVID case. The backlog stretched across the Pacific to the Los Angeles and Long Beach ports, which together handle about a third of all containers arriving in the US. Such disruptions reverberate along the supply chain, then in the US there was an added problem of a shortage of long-haul truck drivers.

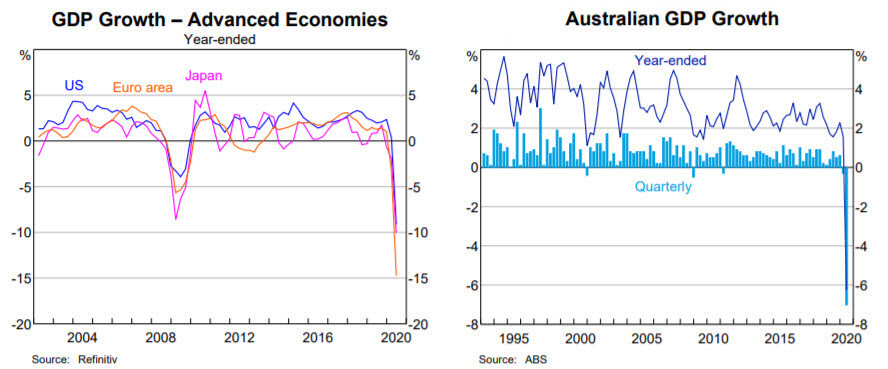

Source: RBA 2021

The shortage of labour became a bigger issue in Q3. There has been confusion as to why US businesses are having trouble hiring and hanging onto workers. In something that has been termed “the great resignation” there could be several factors. The desire for flexibility is one reason. According to the job site Glassdoor, searches for remote work are up 460% in the two years through June 2021. Clearly jobs in restaurants, hotels, and retail can’t be done remotely, but recent articles in publications such as the Wall Street Journal, The New York Times and The Atlantic highlighted changing attitudes to work. Many workers used the pause the pandemic offered, via stimulus payments and free time, to either retrain or look for different work. Some service industry employees returned after lockdown to find the American consumer increasingly rude and verbally abusive, so they tossed in their job. Others simply retired. As the Fed recently highlighted, there is a financial cushion. The net worth of U.S.households was $142 trillion in Q2 2021, up from $110 trillion pre COVID. Beyond investments, there was $17 trillion in cash and cash equivalents on household balance sheets as of June 2021.

In the Eurozone, the Delta variant of COVID continued to spread, but vaccinations rates in the larger eurozone countries now sits around 75% which has seen restrictions on travel and other activities lifted. As the quarter progressed, inflation, due to supply chain issues became a concern. Eurozone annual inflation was estimated at 3.4% in September, up from 3.0% in August. The European Central Bank suggested “inflation is currently being pushed up largely by temporary factors that are expected to fade in the coming years”, announcing a reduction in the pace of asset purchasing, noting it would tolerate a moderate and transitory overshoot of the 2.0% inflation target. The end of the quarter saw a surge in power prices due to low gas supply and weather-related issues over the summer. Germany held a general election, with the Social Democrats (SPD) receiving largest share of the votes. Coalition talks are under way to form a new government.

In the UK, inflation hit 3.2% annually in August, up from 2% in July and the Bank of England took a hawkish tone, voicing concerns publicly that inflationary pressures were surpassing expectations and likely to peak above 4% and remain high until 2022. At the same time, it reiterated its position that it won’t take action for the time being. Like the US and EU, supply bottlenecks constrained output, while natural gas and fuel shortages cropped up towards the quarter’s end. The vaccination programme continued to reduce the number of virus-related hospitalisations despite the emergence of the delta variant. As a result, the UK government moved to the final easing of lockdown restrictions in July. Payroll figures moved above pre-pandemic levels and furloughed workers continued to decline across the UK. GDP figures showed the UK economy grew by 4.8% in Q2.

In Japan, politics dominated as Prime Minister Suga stepped down as leader of the Liberal Democratic Party (LDP). Fumio Kishida took over as party leader and Japanese PM. He will lead the LDP into November’s general election. While Suga faced widespread criticism over his handling of the pandemic and his popularity was fading, the announcement was still a shock given he’d only spent 12 months in the role. PM Kishida has flagged additional fiscal stimulus to support the economy through the pandemic.

China’s woes began to unnerve investors in the quarter as the government looked to assert more control in the technology and property space. In technology, China has dished out large fines for monopolistic practices, Alibaba was hit with a record $3.8 billion AUD fine. In property, authorities are looking to rein in debt and bring prices under control, with Evergrande Group struggling to clear $300 billion of debt potentially being a casualty. Evergrande sparked global investor concerns as a default for the group would not only be disastrous for China’s real estate sector (28% of GDP) but would have a significant domino effect throughout the economy, and potentially globally. China is also facing a power shortage, impacting factories and homes, while also trimming economic growth forecasts.

Emerging market countries saw winners and losers due to power and supply chain issues; this was particularly notable across Asia. In South America, Brazil saw several months of interest rate increases to tackle excessive inflation, flagging another to come in October, while metal prices capped growth for other South American nations such as Chile and Peru. Those with significant energy resources such as Russia and several Middle Eastern economies did well. India continued to make progress against the spread of COVID and by the end of the quarter had administered nearly one billion doses, second only to China.

Back in Australia, data released in September showed the economy grew 0.7% for Q2, with year-on-year growth 9.6%, but showed growth slowing from Q1 before the COVID outbreaks in NSW and Victoria. The continued presence of COVID in the two largest states led to more vaccination urgency. By the end of the quarter, 77.8% of Australians over 16 had been administered their first dose and 54.2% of Australians over 16 were fully vaccinated.

Towards the end of the quarter there were media rumblings there would be an intervention in the mortgage market by the Australian Prudential Regulation Authority. There were suggestions of a limit on borrowing, as various housing markets had increased over 25% annually, fuelled by low interest rates. This followed the OECD and International Monetary Fund both calling on Australian regulators to step in to cool the Sydney and Melbourne property markets.

In its September minutes the RBA again said it “will not increase the cash rate until actual inflation is sustainably within the 2 to 3 per cent target range”. Inflation increased to 3.8% in Q2 2021 with the largest increases coming in fuel, pricing for furniture due to timber prices and supply shortages and childcare as free childcare was ended.

Global economic growth is expected to be 6% for 2021 and 4.9% for 2022, according to the International Monetary Fund. If realized, this would be the fastest growth in several generations as 1973 was the last time growth was 6% or higher.

Market Overview

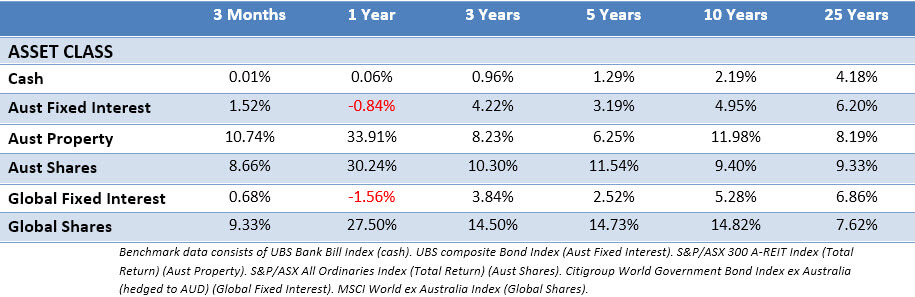

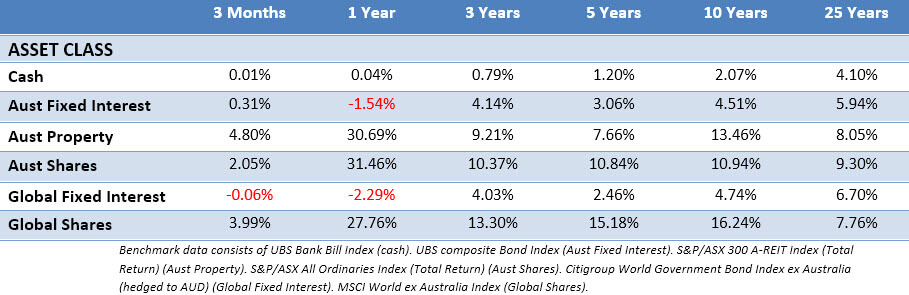

Asset Class Returns

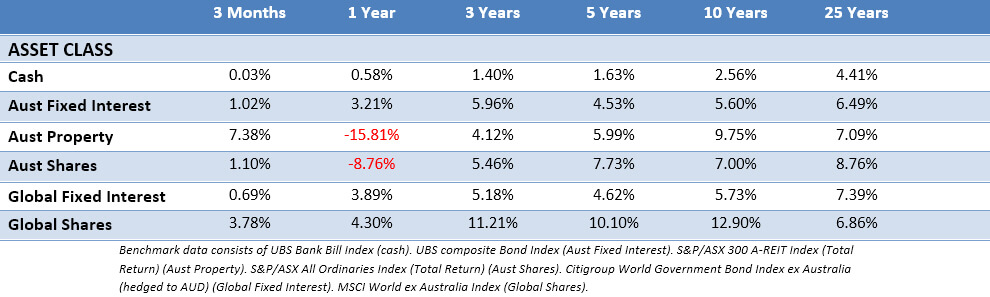

The following outlines the returns across the various asset classes to 30th September 2021.

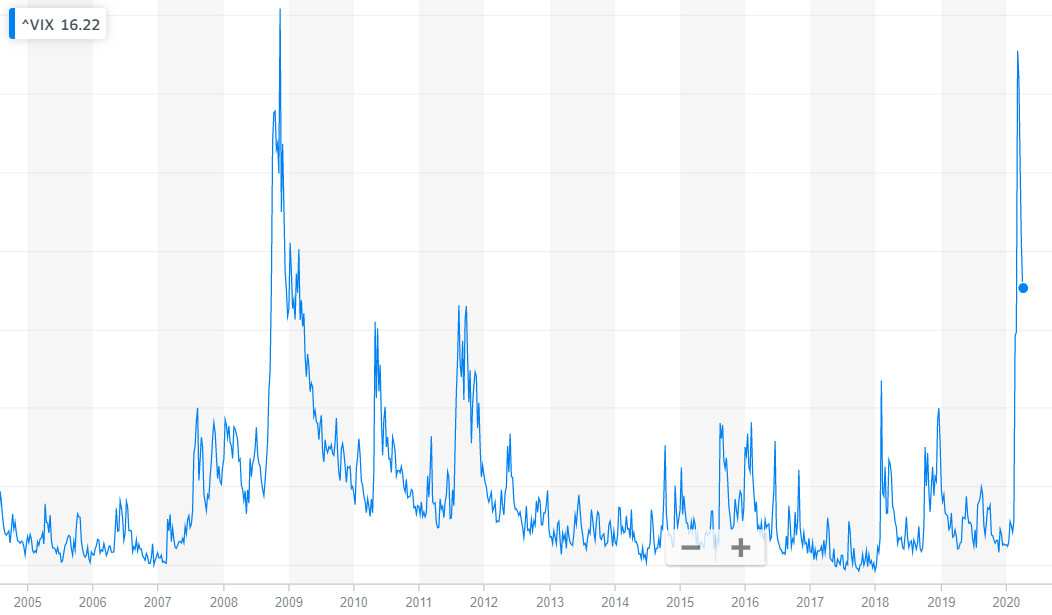

Global sharemarkets in Australian dollar terms were reasonably strong in Q3, albeit with some headwinds emerging in September, which is historically the worst performing month for equities. Yields rose in longer dated bonds in the US and UK, the 10-Year US Treasury yield edged higher from 1.47% to 1.50%, while the UK 10-year yield moved sharply upwards from 0.72% to 1.02%. Despite falling early in Q3, the Australian 10-year yield pushed upwards sharply with the release of Q2 inflation data to finish flat at 1.488%.

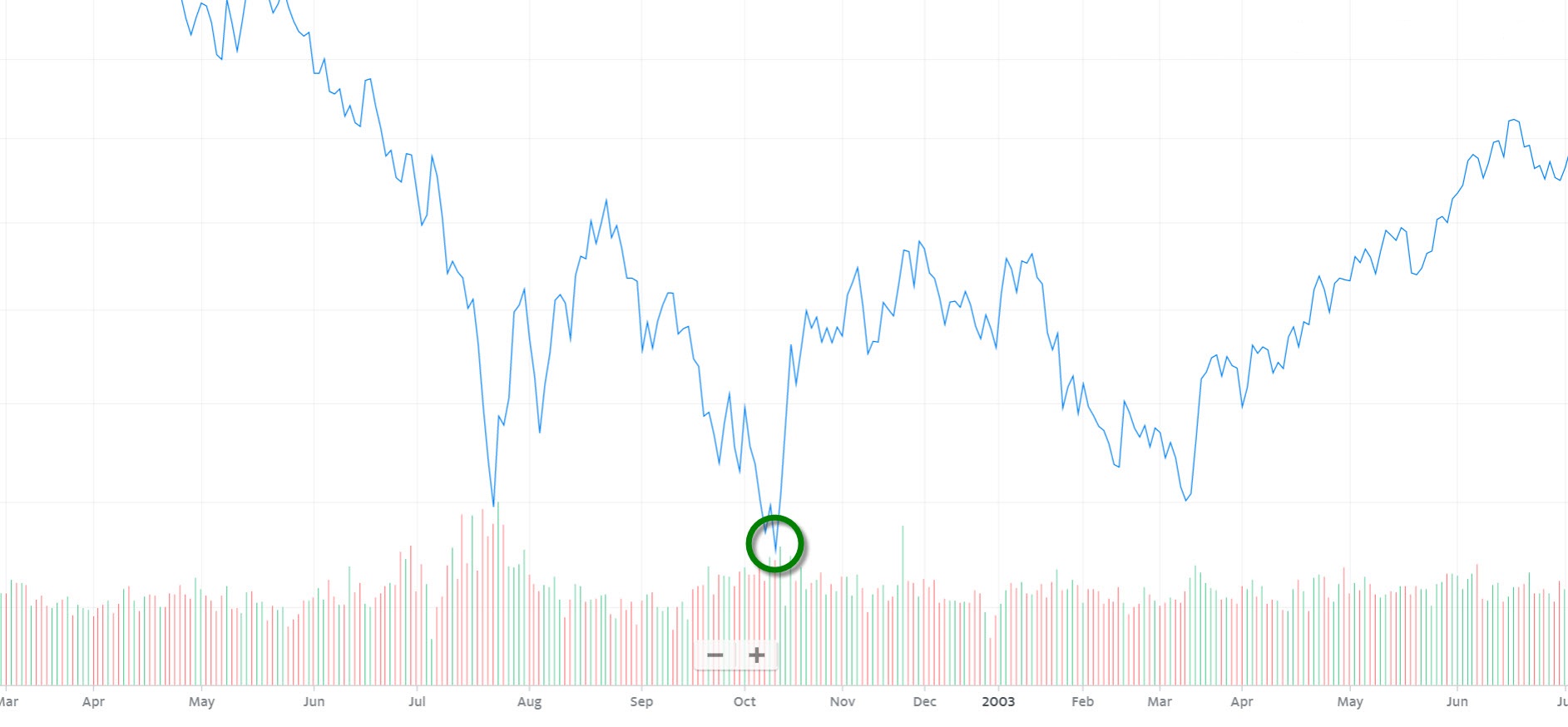

In the US, shares notched a positive return in Q3 with the S&P 500 up 0.58%. Strong earnings had lifted US shares in the run up to August, when the Fed Reserve struck a dovish tone, confirming its hesitance to tighten policy too fast. However, a double whammy of growth and inflation concerns late in the quarter saw US shares pull back in September and deliver their worst month since March 2020. Across the sectors, financials and utilities outperformed while industrials and materials struggled, although the September sell-off hit almost every sector. The exception was energy, as supply constraints drove natural gas and oil prices to highs.

Eurozone shares were mostly flat in Q3. The energy sector was one of the strongest performers, along with information technology with semiconductor-related companies due to the shortage in that space. Consumer discretionary companies struggled, with luxury goods area specifically under pressure with talk China could seek greater wealth redistribution, which could hit demand. Like elsewhere the quarter started positively, due to a series strong corporate results, but pulled back as through the quarter.

UK shares rose made gains in Q3, driven by a variety of factors. The clear sector winner was energy due to rising crude oil prices. Consumer discretionary companies struggled while consumer staples were strong. Merger & acquisition was again a theme. Wm Morrison Supermarkets takeover bid was recommended, US sports betting group DraftKings made a bid to acquire Entain, and US parts manufacturer Parker Hannifin made a bid for UK aerospace and defence equipment supplier Meggit. It was strong quarter for UK shares, outperforming all other major developed markets, with the exception of Japan.

In contrast to much of the world, Japanese shares were rangebound through July and August before rising in September to record a total return of 5.2% for Q3. While corporate results for the previous quarter were strong, sentiment was impacted in August as Toyota announced production cuts in September and October, due to the global shortage of semiconductors.

The rest of Asia and Emerging markets were negative in Q3. This was driven by the significant sell off in China, but also continued supply chain disruptions, worries over the implications of higher food and energy prices weighed on many emerging market countries. Brazil was the weakest market overall, as inflation took hold and its central bank responded with rapid fire rate rises. By contrast, the energy exporters generally outperformed, most notably Colombia, Russia, Kuwait, Saudi Arabia, Qatar and the UAE.

The Australian market (All Ords Accumulation) backed up its strong Q2 with another positive quarter. Transportation, consumer services, insurance and energy were the strongest performers. The strength in transportation can be attributed to the interest of superannuation and global pension funds in infrastructure assets such as airports. Sydney and Auckland airport shares were up sharply for the quarter, along with Qantas. The worst performer was the second largest sector, materials. The iron ore sell off hit BHP, Rio Tinto and Fortescue hard, the trio also went ex-dividend with big payments, but the juicy dividends couldn’t offset the price falls.

This material is provided for information only. No account has been taken of the objectives, financial situation or needs of any particular person or entity. Accordingly, to the extent that this material may constitute general financial product advice, investors should, before acting on the advice, consider the appropriateness of the advice, having regard to the investor’s objectives, financial situation and needs. This is not an offer or recommendation to buy or sell securities or other financial products, nor a solicitation for deposits or other business, whether directly or indirectly.